The US Tax Allocation System is a Pyramid Scheme

||

A New World Order?

|

The US Tax Allocation System (TAS) is truly a Pyramid Scheme

This is clearly seen when you consider how our taxes are allocated to city, county, state, and national governments.

Put all of our taxes in a big pie -- sales taxes to cities, property taxes to county, income taxes and fees to our States, & income taxes to the National government --

then ask yourself:

How are our public tax moneys allocated?

|

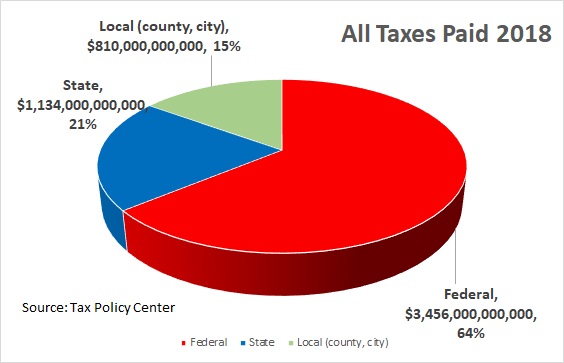

The Current Tax Allocation System

(2018 & 2021):

- 64% of all the taxes you pay, go to the National government

- 21% of all taxes to the state

- 9% of all your taxes to the county

- 6% to the government closest to you, your city government

This Tax Allocation System clearly funnels the vast tax wealth of the people to fewer & fewer persons, to the government furthest removed from the governed,

and conversely, it deprives local government of the countless benefits of taxation,

making cities, counties, and states, beggars, always asking for handouts from Big National government.

The Allocation remains virtually the same year after year, the national govt consuming sometimes as much as 70% of our tax payments.

But as we shall see, it wasn't always this way.

|

Tax Policy Center Link to Source (2021)

|

|

|

|

In this next section we'll explore a brief history on how our

tax allocation system became the source of their wealth

centralizing political power & concentrating our tax wealth to a government far removed from the governed, depriving cities, counties, and states of much needed funds.

|

|

A Brief History of Taxation

|

|

1764 The Currency Act:

King George III forbade the colonies

to conduct any financial transaction with local currency, mandating that

all financial transactions be made in British Crown currency.

According to Benjamin Franklin, the Currency Act was the major cause

of the war with Britain as it turned the colonies from prosperty to poverty in just a few years, creating enormous unrest.

1765 The Stamp Act:

Britain imposes a tax on every single piece of paper (ship's papers, court documents, advertisements, playing cards, and money!).

And this Stamp Act was a schrewd & cunning move by the ruling aristocracy, as currency in the days of Franklin was paper money and bills of credit,

created by local printers and distributed person to person. Bills of Credit were used extensively, so the pre-1764 colonial

financial system was not locked into the private banking cartel.

1773 The Tea Act:

Exuberant in their control of the American colonies' money supply, effectively seizing commerce in the new world,

The Tea Act gave a monopoly on tea to the aristocracy's favored corporation of empire, the British East India Company.

|

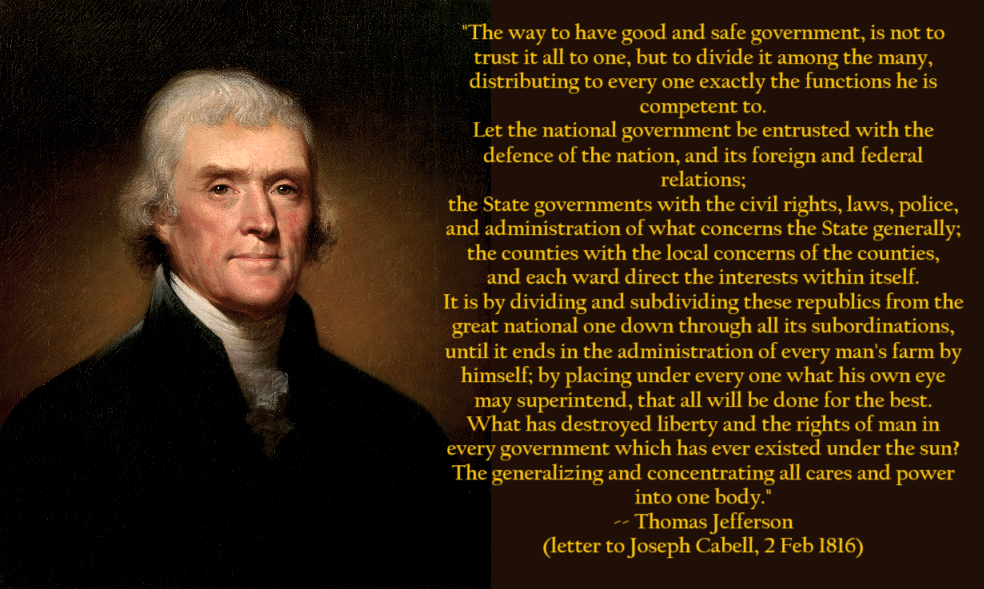

The principal architect of our Declaration of Independence & the 3rd President of the United States, Thomas Jefferson weighs in on the private banking cartels:

.png)

|

1776: Revolution A clarion call for revolution echoes throughout the colonies:

"No more Taxation without Representation".

The Boston Tea Party ignites the flames of revolution.

1787: The US Constitution declares that "Congress shall have power to lay and collect taxes, duties, imposts, and excises."

But for nearly 90 years all financing of the Federal Government was done with tariffs, excise taxes, and import fees.

|

Lincoln on Credit Creation

|

1862: No Federal income tax existed until the Presidency of Abraham Lincoln who enacted an income tax into law to pay for Civil War debt.

Still this was a very low tax rate of 3% on incomes between $600 to $10,000; and 5% tax on incomes greater than $10,000.

|

1913: The same year that the Federal Reserve is established, a Federal / National income tax is enacted into law, and the first 1040 form is created.

Initially, the national income tax was a very modest 1% for incomes over $3,000, and 7% on incomes greater than $500,000.

To be sure, the Federal Reserve is neither 'Federal' nor does it have any 'Reserves'.

The 'Fed' is, however, a privately owned central bank masquarading as the bank of the People of these United States,

and its member banks, the "too big to fail banks", are the sole depositories of the National Tax Wealth as the National, State, County,

and City governments are presently 'depositing' our taxes in these "too big to fail banks", the Wall Street banks,

and the privately owned & privately controlled central banks of this world.

INSTEAD, we taxpayers should insist that our tax moneys be deposited in local Public Banks.

|

Emma Goldman corroborates the atrocities of the central banking cartel:

|

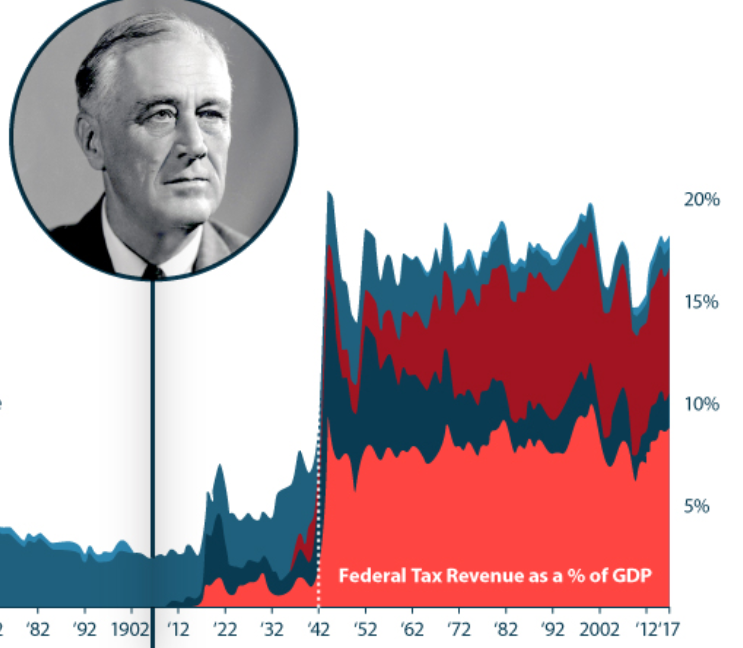

The Rapid Rise of National Power thru Federal Taxation

|

1918: War once again plays a major role in the 1918 Revenue Act, and taxes skyrocket to pay for the war efforts with a top tax rate of a staggering 77%.

1942: The Revenue Act. The 2nd World War comes at a great cost to the American taxpayer, more than doubling the tax burden from $3.4 Billion to $8.0 Billion.

And in 1943 it becomes mandatory for employers to withhold national income taxes from employees' wages and remit them four times a year,

making your employer an accomplise in the fleecing of the American people,

the taxpaying public that sustains this pyramid scheme.

1961: Beginning of the Computer Age.

The National Computer Center at Martinsburg, West Virginia is formally dedicated to assisting the Internal Revenue Service (IRS) in its shift to computer data processing.

|

As we can see from the brief history of taxation, the national government steadily & inexoribly increases its powers to tax the American people.

For almost 90 years after the Constitution was ratified, no taxes are levied on income, and all national government financing comes from excise taxes, tariffs, and import fees.

Again and again WAR

plays a critical role in the taxation of our income, and is used by national government repeatedly to extract more and more personal income from the general public.

Laws are enacted mandating employers to extract taxes from employee payrolls, unjustly making your employer a Tax Collector. The tax burden steadily increases on the working class and rarely decreases.

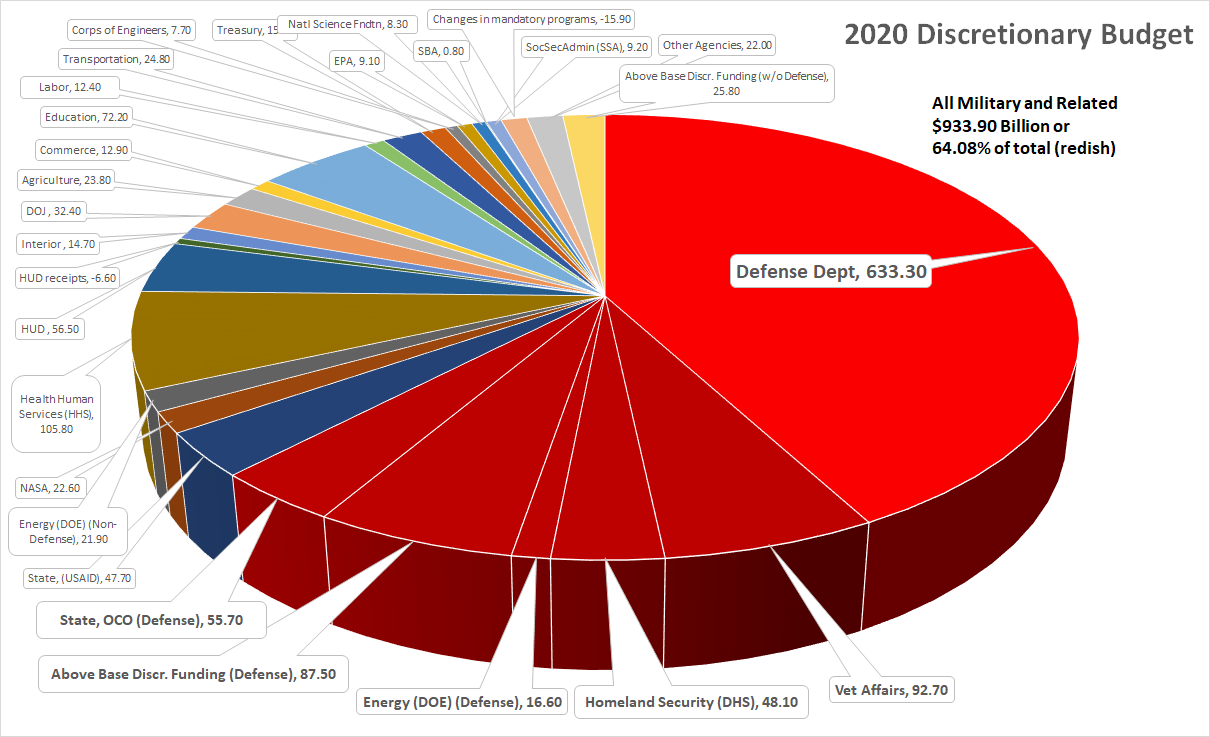

And what does the national government do with all this tax wealth?

What does the national government do with 64% of all the taxes you pay?

The evidence is abundantly clear: it builds and maintains, at punitive cost to the American people, a global military empire with over 1000 military bases around the world:

|

The taxes we pay from our labor to the national government comprise 64% or more of all the taxes we pay to all our governments (city, county, state, national).

And with this enormous tax wealth the national government builds & maintains a vast military empire that has a long history of overthrowing popularly elected

governments

in South & Central America,

the Middle East,

and in Africa ... and here: wikipedia.

And 64% of all the taxes paid for the national discretionary budget are consumed by

the military industrial complex and related departments of the national government, leaving every city, county, and state beggars of national largesse, and all other discretionary social service programs scrambling for the remaining 36%.

This, more than any other factor, is the main reason why we don't have a universal health care system, why more & more people are becoming homeless, why fewer & fewer

people can afford an education, and it is the primary reason for the growing poverty in our population.

|

Link to 2020 Discretionary Budget: see '2020 Enacted'

Link to 2020 Discretionary Budget: see '2020 Enacted'

|

The 'Great Seal' pyramid on the dollar bill is clearly borrowed from the iconic Egyptian pyramids and put on the dollar in 1935 during the King Tutankamen craze that swept the nation at the time.

The original pyramids of Giza had a capstone that was overlaid with a very thin layer of gold, before they were pillaged by bandits.

|

Like the millions of blocks of stone that support the thin layer of gold atop the pyramid capstone (look closely),

the people of these United States are financing a very few people at the very top that have all the gold, and pull all the strings of national political power.

The inscription on the American Dollar "Novus Ordo Seclorum" is from the Latin, "New Order of the Ages", or in contemporary lingo:

New World Order.

Unfortunately for us all, this "New Order", this man-made structure is as old as the Pyramids of Giza as its structure concentrates wealth & centralizes political power.

And there is nothing 'democratic' about concentrated wealth and its corollary of centralized national or transnational political power.

Political power is best distributed broadly and in a decentralized way, favoring local self-governance and local economic empowerment first.

|

Pyramid with Gold Capstone -

Illustration of the Pyramid of Giza, Egypt.

|

|

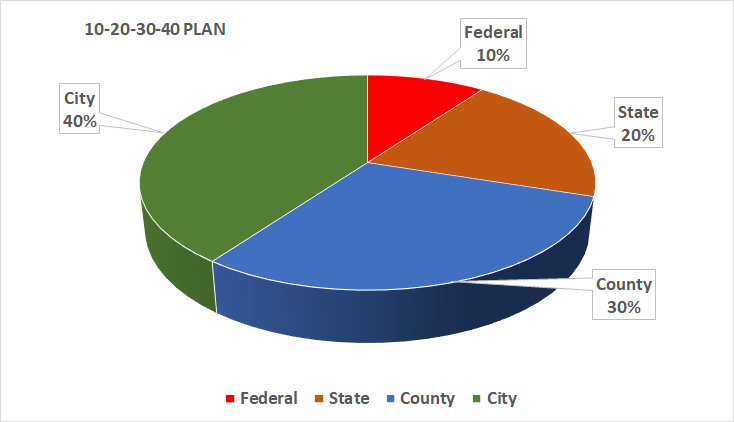

To be perfectly clear, we are not opposed to taxation per se, but to the current Tax Allocation System that funnels the vast wealth of the American people to

a national government that is no longer accountable nor responsive to the plight of its people. We are proposing a New Tax Allocation System that redistributes

our tax wealth more to city, county, and state governments, while disciplining the national government.

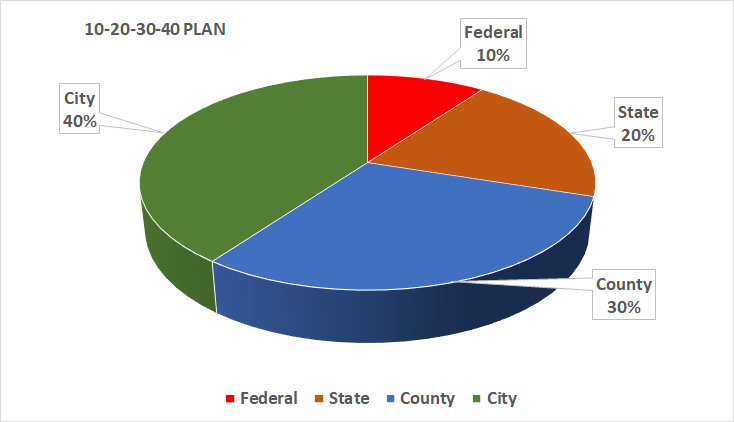

We propose a

10-20-30-40 Plan

that puts 100% of our taxes to work for the local economy and the local public good.

We can Invert this Power Pyramid. Click to find out how.

|

|

|

|