For over 100 years the American people have been duped into a private banking scheme known to us as the falsely named

'Federal Reserve'. These private banks include JPMorganChase, Bank of America, Citi Bank, Wells Fargo, and a few others,

and they have directed the U.S. economy in cycles of boom and bust, capitalizing on misfortunes of the people and stealing their wealth.

Every city, county, and state -- with the sole exception of one -- delivers your tax dollars to this private banking cartel,

and they in turn invest it on Wall Street.

Between 1994 and 2024 the combined total of the taxes collected by every city, county, and state in the United States, loaned to the

private monopoly banks, exceeds 35 TRILLION DOLLARS,

this according to the Federal Reserve Economic Database..

They fund the war machine, the fossil fuel industries, and the largest monopoly corporations. Is it any wonder that our country has been

steadily and inexorably sliding toward a corporatocracy?

To win back our country, we must take back our money from Wall Street and invest it in Main Street with the establishment of

city, county, and state public banks as sole depositories of our tax wealth,

and chartered to invest and multiply that community wealth only in the defined jurisdiction. #PublicTaxesInPublicBanks

|

"The privilege of creating and issuing money is not only the supreme prerogative of Government, but it is the Government's greatest creative opportunity. By the adoption of these principles, the long-felt want for a uniform medium will be satisfied. The taxpayers will be saved immense sums of interest, discounts and exchanges. The financing of all public enterprises, the maintenance of stable government and ordered progress, and the conduct of the Treasury will become matters of practical administration. The people can and will be furnished with a currency as safe as their own government. Money will cease to be the master and become the servant of humanity." -- Abraham Lincoln

|

|

Initiative #2 - Establish Public Banks in every city, county, and state.

-

Currently, almost without exception, each city, county, and state government are depositing your tax wealth

in privately owned Wall Street mega-banks, and thereby depriving local government of the enormous wealth of the taxpayers.

State, county, and municipal governments are literally making loans to these 'Federal Reserve' banks whenever they deposit your taxes in these "too big to fail" banks:

JPMorganChase, Bank of America, Citi Group, Wells Fargo, and a handful of others.

evidence shows that big banks invest in big corporations. They care little to none about local communities and small or medium sized companies. In fact, the largest banks build monopolies in every sector of the economy.

-

There are 3 competing and mutually exclusive theories on the role of banks in the economy. And according to international banking expert,

Prof. Richard A. Werner, there has never been an empirical study of what happens internally in a bank when they issue you a loan for a car, a home, or a business...until now. The 3 theories are:

- The Intermediation Theory

This theory is presently dominant in most economic textbooks, and has been in place since the 1960s. This theory of banking states that banks are just intermediaries between depositors and borrowers, as they charge a little interest for moving money between accounts. Nothing to see here with banks as their role in the economy is virtually insignificant. When you get a loan from the bank, money is transferred from one account to another.

- The Fractional Reserve Theory

The fractional reserve theory says that banks do not create money individually, but collectively, like magic, new money is created in the collective activity of all the banks. This theory was popular from the 1920s to the 1960s.

- The Credit Creation Theory

This is the oldest theory of banking, and simply stated, it asserts that banks create money whenever they issue a loan. This theory predates 1920 and is validated by the first-ever empirical study of what banks do when they provide loans, conducted by Professor Richard A. Werner. You can read the study here: Can banks individually create money out of nothing? Or watch this youtube informative video.

- Moreover, according to Prof. Werner, in law, a 'deposit' does not exist. It's a fiction conjured up by the banks. When you or your governments make a 'deposit' in a bank, you are making a 'loan' to the bank, and a transfer of ownership occurs: the bank becomes the new owner of your money, and you are considered one among many creditors. The bank makes a record of the IOU which the bank calls a 'deposit'. See Werner here

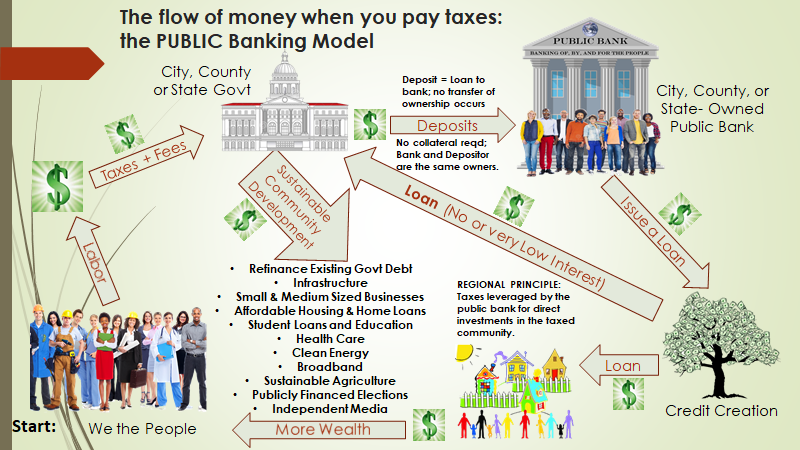

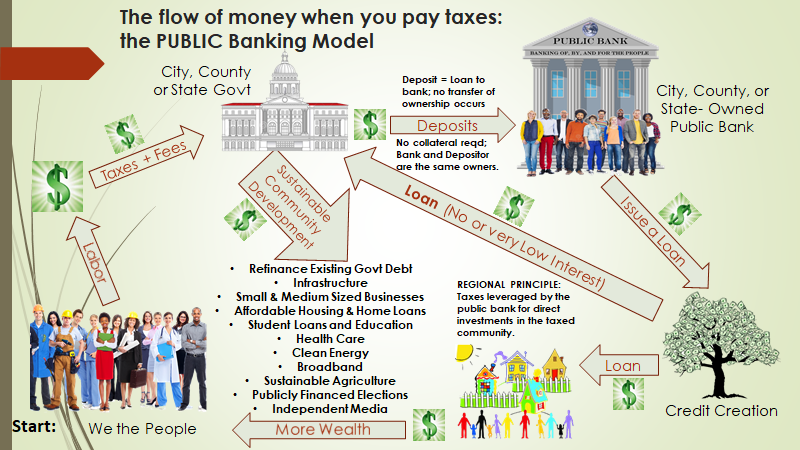

- The Public Banking Model

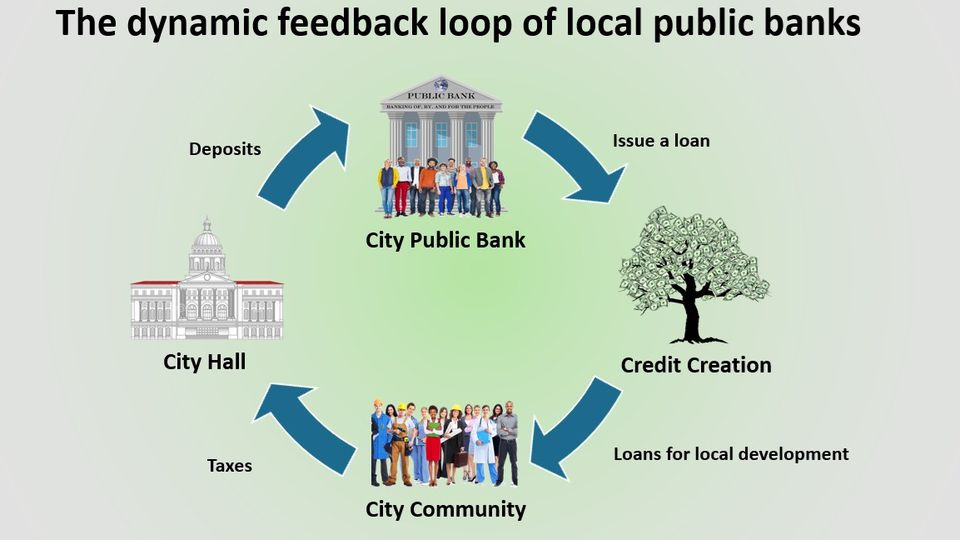

Unlike the PRIVATE Banking Model, your tax wealth will be reinvested directly into your community with PUBLIC banks, providing all the financing needed at very low interest rates, returning your tax wealth back to the community, multiplied many times. The powers of Credit Creation are returned to the people and used for their community development and for the public good. This image illustrates how a powerful economic engine is created when a public bank is established

in your city, county, or state.

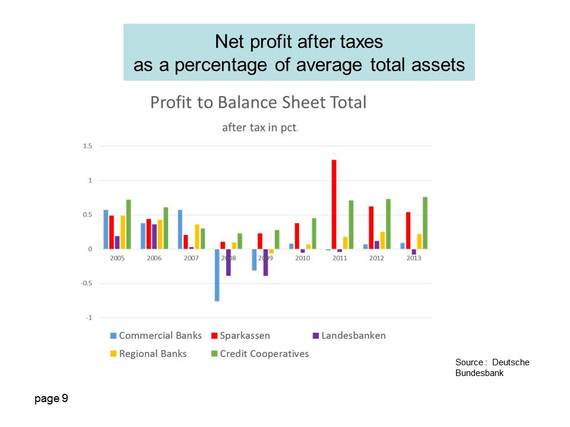

Why Public Banks Outperform Private Banks

- Germany's Sparkassen Banks "The Sparkassen [Germany's Public Banks] were instituted in the late 18th century as nonprofit organizations to aid the poor. The intent was to help people with low incomes save small sums of money, and to support business start-ups. Today, about half the total assets of the German banking system are in the public sector. (Another substantial chunk is in cooperative savings banks.) Local public banks are key tools of German industrial policy, specializing in loans to the Mittelstand, the small-to-medium size businesses that are at the core of that country's export engine. The savings banks operate a network of over 15,600 branches and offices and employ over 250,000 people, and they have a strong record of investing wisely in local businesses."

Read more here.

- For more info, check out the Public Banking Institute and Rocky Mountain Public Banking Institute

Public banking divests from Wall Street while investing in Main Street, chartering a City Public Bank to be the sole depository bank for taxpayer money, and to allocate the proceeds for the local community's health and well being, and for a sustainable future.

Unlike the Private Banking Model -- now implemented throughout the USA -- the Public Banking Model assures that the taxes you pay to your city, county, or state remain in the local jurisdiction.

Following the Regional Principle of public banking, your tax wealth is reinvested in the local community and multiplied many times, providing all the financing needs of the community the public bank serves.

-

As you earn an income, then pay your taxes to your city, county, or state, the respective governments will be required to deposit your taxes in the public bank associated with the government ... similar in practice to both the Bank of North Dakota and the Sparkassen banks of Germany.

-

Chartered to invest only in the local community, and employing the powers of a bank to create money, the public bank can issue low cost loans to both the community and the local government,

thereby returning and multiplying the wealth of the community, supporting SMEs (Small & Medium sized local Enterprises), and providing abundant financing for the community.

- Here is an illustration of how a Public Bank will work ... from the Public Banking Institute: