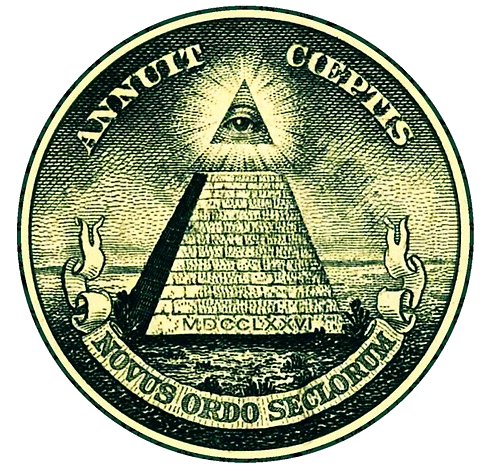

While the pyramid on the dollar may seem stable and immovable, therein lies the grand deception.

Banking in the public interest requires distribution of public wealth to the local community, hence the inverted pyramid.

It might seem imbalanced at first glance, but it will focus your energy to the local centers of power.

|

As we have seen, the current Tax Allocation System is configured in such a way that the government furthest from us, the national government

receives about 2/3rds of all our tax payments, and the government closest to us, our city government gets the least amount of our tax wealth,

a pittance of about 6%. And we call this structure a Pyramid Scheme that funnels the vast tax wealth of the American people to a government

far removed from us, receiving all the benefits of ultimate power with the least amount of accountability to the people.

And from the History of Taxation we find that the Federal Income Tax was $0 for the first 90 years after the enactment of the Constitution.

|

|

The 2 charts above illustrate the real time flow of money that you pay in taxes to your City, County, State, and National governments.

The top chart illustrates the Current Tax Depositing System which we define as the "PRIVATE Banking Model of Taxation" where all the taxes we pay

to our governmets are 'deposited in' (aka 'loaned to') one of the several 'too big to fail' private banks. You know their names (jpmcboaciti..etal)

******

The bottom chart - a flow diagram - represents the phenomenal success that public banks across the world have experienced when the taxes of the people are 'loaned' to a

bank owned by the people of the jurisdiction it represents: city, county, state.

A dynamic economic engine is created with publc banks that reinvests & multiplies taxpayer taxes many times,

constrained by the Regional Principle restricting bank investments to the local community.

The Sparkassen Banks of Germany are the best example of this type of local publicly owned banking systems.

The Sparkassen community savings banks have built the world's best "hidden champions", local small and medium enterprises (SMEs) that excel by far in the export industries,

second only to China. After repeated wars, the German economy remains resilient in large part because of these Sparkassen Banks --

that account for 42% of the German economy and 70% of the German small business market -- These Sparkassen banks are the back-bone of the economy as they are contrained by law & charter to the "Regional Principle" to reinvest only in the local community it represents.

(see Mark K. Cassell's work Banking on the State: The Political Economy of [Germany's] Public Savings Banks [Sparkassen]

|